what is a levy on personal property

Tangible property includes movable man-made objects that have a physical form and can be seen and touched. Levy basically means that the officer takes the property such as your baseball card collection or instructs the holder of the property like your bank to turn it over to the officer.

3 760 Likes 92 Comments Twiggy Levy Halona Glass Twiggylevy On Instagram Wildflowers A Deeply Person Stained Glass Art Stained Glass Fused Glass Art

Additionally unless you have a writ of execution.

. Levies are different from liens. What is Personal Property. A levy is when a creditor is allowed to take and sell your personal property.

Under that statute municipalities can assess levy and collect taxes for general or special purposes on all property subjects or objects that may be. It can garnish wages take money in your bank or other financial account seize and sell your vehicle s real estate and other personal property. Property tax levy against real and personal property for general taxes for fire districts RCWs 8452070 and 8452040.

Personal Property Levy Forms Writ Notice of Levy Claim of Exemption not for wage garnishment Personal property levy fees. Personal property can be broken down into two categories. Levy on personal property is made by taking physical possession thereof.

Generally personal property means assets other than land or permanent. Personal Property Levy Instructions to the Sheriff of San Joaquin County NORMAL HOURS FOR SERVICE ARE MONDAY FRIDAY 800 AM. Chattels refers to all type of property.

A levy is the legal seizure of property to satisfy an outstanding debt. The tax is levied by the governing authority of the jurisdiction in which the property is located. This tool is very useful when the debtor owns valuable tangible assets or the debtors.

Money in a deposit account personal property owned by the judgment debtor in the judgment debtors possession personal property owned by the judgment debtor in a third parties possession a vehicle or vessel owned by the judgment debtor the debtors interest in personal property of a. This can be a tax levy or some other form of judgment. When a Levy on Personal Property is requested the Execution empowers Deputy Sheriffs to seize the personal property of the defendant.

A personal property levy allows a creditor to obtain possession of much of the debtors property in California eg equipment inventory vehicles cash in cash registers excluding real property and property held by third parties. Multiply the assessed value of your property 1500 by the mill levy 120 mills or 120. A levy actually takes or seizes a taxpayers property to satisfy their tax debt.

A levy is a legal seizure of your property to satisfy a tax debt. The line of ownership must be clear and the defendant listed on the Execution must exactly reflect the ownership of the personal property. A levy is simply a legal seizure of your property in order to satisfy your unpaid tax debt.

The municipal tax authority sets a percentage rate for imposing taxes called a levy rate which is then calculated against the assessed value of each homeowners property ad valorem literally. Maximum Property Tax Regular Levy Rates. 1430 2860 5720 5720.

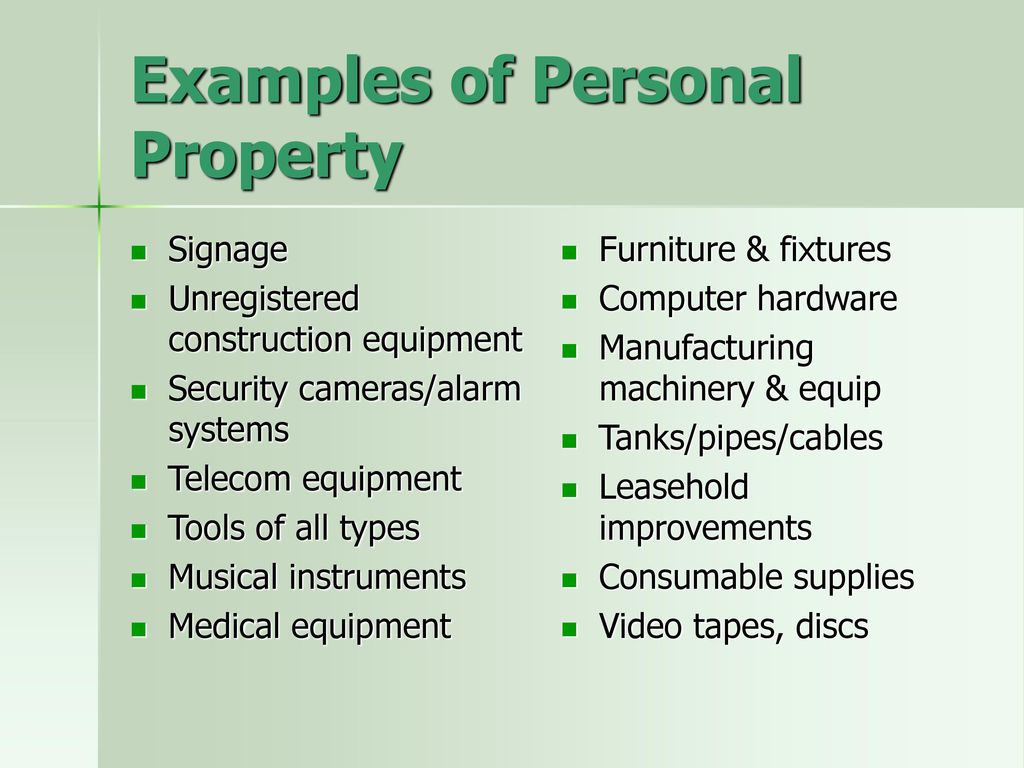

If you fail to pay your taxes the Internal Revenue Service may respond by. Examples of typical property subject to levy include. After taking your property the sheriff or marshal sells it at a public auction and.

5000 Market Value x 30 Assessment Ratio 1500 Assessed Value AV x 120 Mill Levy 120 mills per 1000 AV 180 Tax Amount. Not applicable for BANK and VEHICLE Levy- See above You are required to identify and describe the property to be levied upon. Levy On Personal Property Writs Executions When a Levy on Personal Property is requested the Execution empowers deputy sheriffs to seize the personal property of the defendant.

A lien is a legal claim against property to secure payment of the tax debt while a levy actually takes the property to satisfy the tax debt. An IRS levy permits the legal seizure of your property to satisfy a tax debt. Levy An IRS levy permits the legal seizure of your property to satisfy a tax debt.

Municipalities derive their authority to tax business property from CGS 7-148 c 2 B which is a part of a section of a statute that delineates their other general powers. In many cases this property is a motor vehicle or piece of equipment belonging to the defendant. If a levy amount is certified to the county assessor after the thirtieth day of November the county assessor may use no more than the county legislative authoritys certified levy amount for the previous year for the taxing.

Not every state requires personal property. A personal property tax is a tax levied by state or local governments on certain types of assets owned by their residents. A personal property tax is a levy imposed on a persons property.

The answer is 180 which is your share of the costs of public services. Often individuals use it regarding the tangible property such as a purse or clothing. The tax is levied by the jurisdiction where the property is located and it includes tangible property that is not real property.

025 050 100 100. Peaceful EntryForcible Exit Use of. The regular rates of levy may not exceed the following amounts.

How to Levy Personal Property If you find non-exempt property that is moveableTAKE IT What are the restrictions and limitations you have in executing a writ. A property tax or millage rate is an ad valorem tax on the value of a property. Rates are given in cents per 10000 Taxing Authority Class I Class II Class III Class IV.

In many cases this property is a motor vehicle or piece of equipment belonging to the defendant. Some chattels are attached to land and can become a part of real property which are known as fixtures. A lien is a legal claim against property to secure payment of the tax debt.

Personal Property Levies as a Judgment Collection Tool. A personal property levy does not include real property. A personal property levy is a legal way for creditors to obtain possession of a debtors personal property to satisfy a judgment debt.

How South African Non Income Taxes Are Paid Income Tax Income Indirect Tax

Pledge Of Personal Property Template Google Docs Word Apple Pages Template Net Job Description Template Job Description Templates

Caao Aat Personal Property Workshop Ppt Download

A Business Tangible Personal Property Tax T Ppl Is A Levy On Business Equipment Real Estate Plant And Equipment Software Personal Property Property Person

Download Policy Brief Template 40 Brief Policies Ms Word

Free 4 Subordination Agreement Forms In Pdf Ms Word For Lottery Syndicate Agreement Template Word Great Cre Lottery Invoice Template Word Being A Landlord

What Is Personal Property Tax Property Tax Personal Property Tax Guide

What Causes T Bone Accidents In 2022 Car Accident Lawyer T Bone Car Crash

Pin By Balboa On Personal Finance Personal Finance Good Advice Frugal

2 Va Tax Receipts 1 Slavery Related 1 Dated 1844 And 1 Later In 1871 Both In Excellent Condition W Usual Fold Lines Historical Documents Auction State Tax

Installment Payment Contract Template Luxury Payment Plan Agreement Template 21 Free Word Pdf How To Plan Business Plan Template Free Contract Template

Best Tax Attorney In Dallas Tax Attorney Tax Lawyer Tax Refund

This Upscale California Garden Party Is Proof That A Classic Wedding Can Feel Personal Green Wedding Flowers Wedding Classic Green Boutonniere

Need Help Finding Sellers In Your Area Talk With Our Team About How We Might Be Able To Help It Only Takes 15 Realistic Expectations Price Offer Instruction

Branford Dixie County Fl Land For Sale Property Id 337937601 Landwatch Undeveloped Land Lakefront Property Land For Sale

Collecting On Unpaid Judgments Judgment Recovery Procedures Judgment Procedure Being A Landlord

Pin By The Project Artist On Understanding Entrepreneurship Tax Haven Old Apartments Understanding

Some Banks Begin Levying Mdr Charges On Debit Card Payments Debit Card Payment No Worries

Homes For Sale Real Estate Listings In Usa Investment Property Property Tax Real Estate Buying