when are property taxes due in will county illinois

The county anticipates collecting nearly 2 billion in property taxes this year Brophy said. Your tax bill may include separate property tax rates paid to everything from the county township.

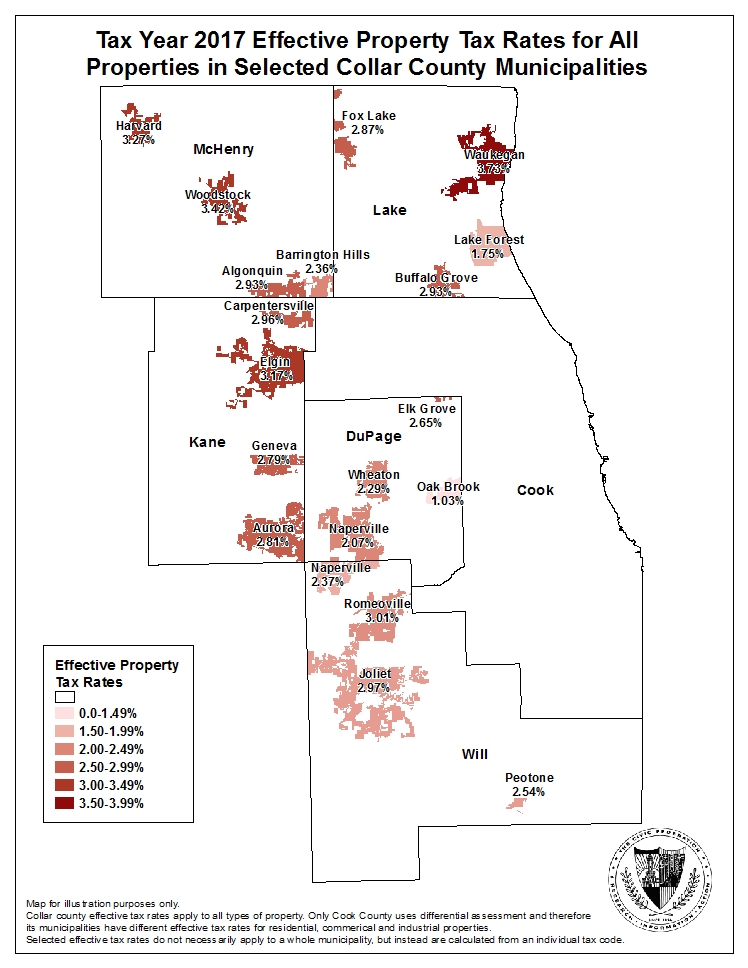

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

The average yearly property tax paid by Will County residents amounts to about 588 of their yearly income.

. The delayed property tax payment enables property owners an additional two 2 months to pay their taxes that were originally due on August 3. 100 Free Federal for Old Tax Returns. In most states you may pay property taxes to just one to three taxing bodies.

Tax bills are mailed out in the month of May. Several options are available for you to consider when paying your Peoria County property taxes. 3 as the due dates for 2021.

In Illinois there are almost 7000 local taxing bodies. Find out more about delinquent tax and property tax relief. 3 penalty interest added per State Statute.

Those funds then are distributed to roughly 360 government bodies such as. 45 penalty interest added per State Statute. Due dates will be as follows 1 st Installment due June 1 2022 with the interest to begin accruing June 2 2022 at 15 per month post-mark accepted.

The taxes are based on the real estate market value and are levied by local governments such as school districts municipalities townships etc. In most counties property taxes are paid in two installments usually June 1 and September 1. 15 penalty interest added per State Statute.

Last day to submit changes for ACH withdrawals for the 1st installment. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax. Important Facts about your Kendall County Property Tax Bill.

Learn about how to prepay your real estate taxes through this program. Will County property tax due dates 2022. Mail your tax bill and payment to.

Residents wanting information about. Winnebago County has one of the highest median property taxes in the United States and is ranked 151st of the 3143 counties. The property tax due dates are April 30 and October 1for the first and second half instalment respectively.

Tuesday March 1 2022. 2020 - Property Tax Due Dates. You can use the Illinois property tax map to the left to compare Will Countys property tax to other counties in Illinois.

2021 Taxes Due 2022. First Date for Filing a Petition for Tax Deed May 23 2019. If you do not receive your tax bill please contact the Kendall County Collector at 630 553-4124.

Contact your county treasurer for payment due dates. In order to keep Will County residents safe during the unprecedented COVID-19 crisis and offer convenient ways to pay Will County Treasurer Tim Brophy has announced alternate deadlines and methods to pay property taxes. Mobile Home 50 Late Penalty Assessed May 30 2019.

Will County Treasurer Tim Brophy said the board should establish June 3 Aug. DuPage County Property Taxes 2022. Mobile Home 25 Late Penalty Assessed May 1 2019.

How to Pay Your Tax Bill. The Treasurer is also the County Collector. Property Tax First Installment Due Date.

The property tax rate in Will County Illinois is 205 costing residents an average of 4921 per year. Real Estate Property Tax Bills Mailed May 1 2019. The phone number should be listed in your local phone book under Government County Assessors Office or by searching online.

Will County is ranked 43rd of the 3143 counties for property taxes as a percentage of median income. 1st installment due date. A United States Postal Service postmark is accepted as date of payment in the calculation of a late penalty.

Will County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. For those who pay the tax within 30 days of the due date and do not owe back taxes on the same property the. It is managed by the local governments including cities counties and taxing districts.

The first due date is July 6th and the second due date is September 6th. The median property tax also known as real estate tax in Will County is 492100 per year based on a median home value of 24050000 and a median effective property tax rate of 205 of property value. Mobile Home Delinquent Notices Sent June 4 2019.

If you are a taxpayer and would like more information or forms please contact your local county officials. Mobile Home Due Date. The median property tax in Winnebago County Illinois is 3056 per year for a home worth the median value of 128100.

Any first installment taxes that are paid after July 6th will incur an Illinois State mandated 15 penalty per month any 2nd installment taxes that are paid after September 6th will also incur the state mandated 15. Box 1216 Rockford IL 61105-1216. You can pay the bill in two installments.

The 2021 payable in 2022 property taxes were mailed on June 3rd. You may pay in person at Winnebago. Winnebago County collects on average 239 of a propertys assessed fair market value as property tax.

Will County Gives You More Time To Pay Property Taxes - Joliet IL - Will Countys new schedule means half the first property tax bill is. Failure to receive your real estate tax bill or receiving one late will not negate your responsibility to pay your taxes or late penalties. Real Estate First Installment Due June 5.

Property Tax Second Installment Due Date. To avoid any late penalty the payment must be made on or before due date. Goral Winnebago County Treasurer PO.

Mobile Home Tax Bills Due April 23 2019. Illinois has one of the most complex and confusing property tax systems in the country. Property tax bills mailed.

It is important to maintain the countys tax cycle to ensure revenues are available to continue critical services for our. 2 nd Installment due September 1 2022 with the interest to begin accruing September 2 2022 at 15 per month post-mark accepted.

Cook County First Installment Property Tax Bills Due March 1 2022 Village Of Barrington Hills

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

The Cook County Property Tax System Cook County Assessor S Office

How Is A Tax Bill Calculated Tim Brophy

Online Payment System Tim Brophy

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

2nd Installment Of Real Estate Taxes Due Will County Illinois Home

Dupage Property Tax Due Dates Fausett Law Office

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

North Central Illinois Economic Development Corporation Property Taxes

The Cook County Property Tax System Cook County Assessor S Office

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation